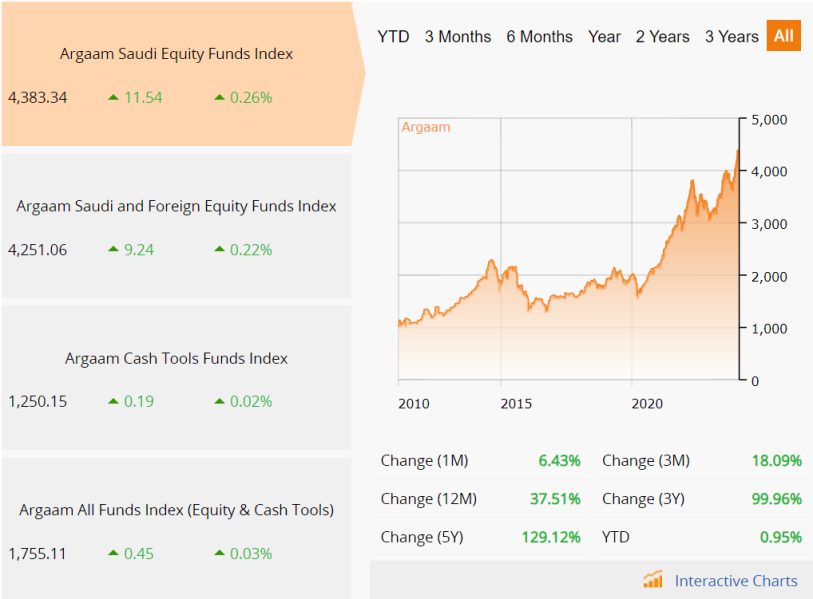

Argaam Financial Portal announced launching four exclusive indices to measure and monitor the performance of more than 260 investment funds operating in Saudi Arabia.

The first-of-its-kind indices in the region measure the performance of different groups of investment funds, based on the type of invested assets, and the geographical concentration of an investment.

The four indices that measure the performance of different types of funds are calculated weekly, to reflect the changes that occur during the week in the group of funds that constitute each index, according to specific weights for each fund.

These funds are classified into four indices, as follows:

Argaam Index for Saudi Equity Funds:

It measures the performance of a group of funds investing in listed stocks, IPOs, and rights issues in the Saudi stock markets, as well ETFs and REITs.

Argaam Index for Saudi and International Equity Funds:

It measures the performance of funds investing in the Saudi, GCC and global equity markets, IPOs, rights issues, as well ETFs and REITs.

Argaam Index for Money Market Instruments Funds:

It measures the performance of funds investing in Murabaha contracts, composite Murabaha, Ijara, short-term securities, Murabaha funds, in addition sukuk and sukuk funds.

Argaam All-Fund Index (equity and money market):

It measures the performance of various types of investment funds, whether equities or money, as well as local and international funds.

The page can be accessed through the Mutual Funds page as shown:

The basis point for each of the four indices is 1,000, as of January 1, 2010. The weights of the funds included in the index are periodically reviewed based on specific criteria.

The launch of these indices aligns with Argaam team's efforts to assist analysts, investors, and fund managers in measuring the performance of various types of investment funds. It aims to keep pace with developments in this type of investment tools, given investor growing interest.

The new indices are driven by Argaam’s commitment to offering quality services to investors in Saudi Arabia. Since its launch, Argaam has aimed to provide various services and products that assist investors and decision-makers in making enlightened decisions. This includes comprehensive daily coverage of the economy and the capital market in Saudi Arabia, as well as a range of interviews, meetings, reports, and exclusive studies. Additionally, Other offerings include Argaam Plus, Argaam Tools, etc.

Most Read

TALCO sets TASI IPO price range at SAR 40-43/share

Miahona net profit rises 14% to SAR 56.9M in 2023

Saudi Arabia's airports see 20% rise in passengers in Q1 2024: GACA

King Salman completes medical checkups, to receive treatment

Saudia announces largest Airbus deal of 105 aircraft